Saving For Your Health: Health Savings Account (HSA)

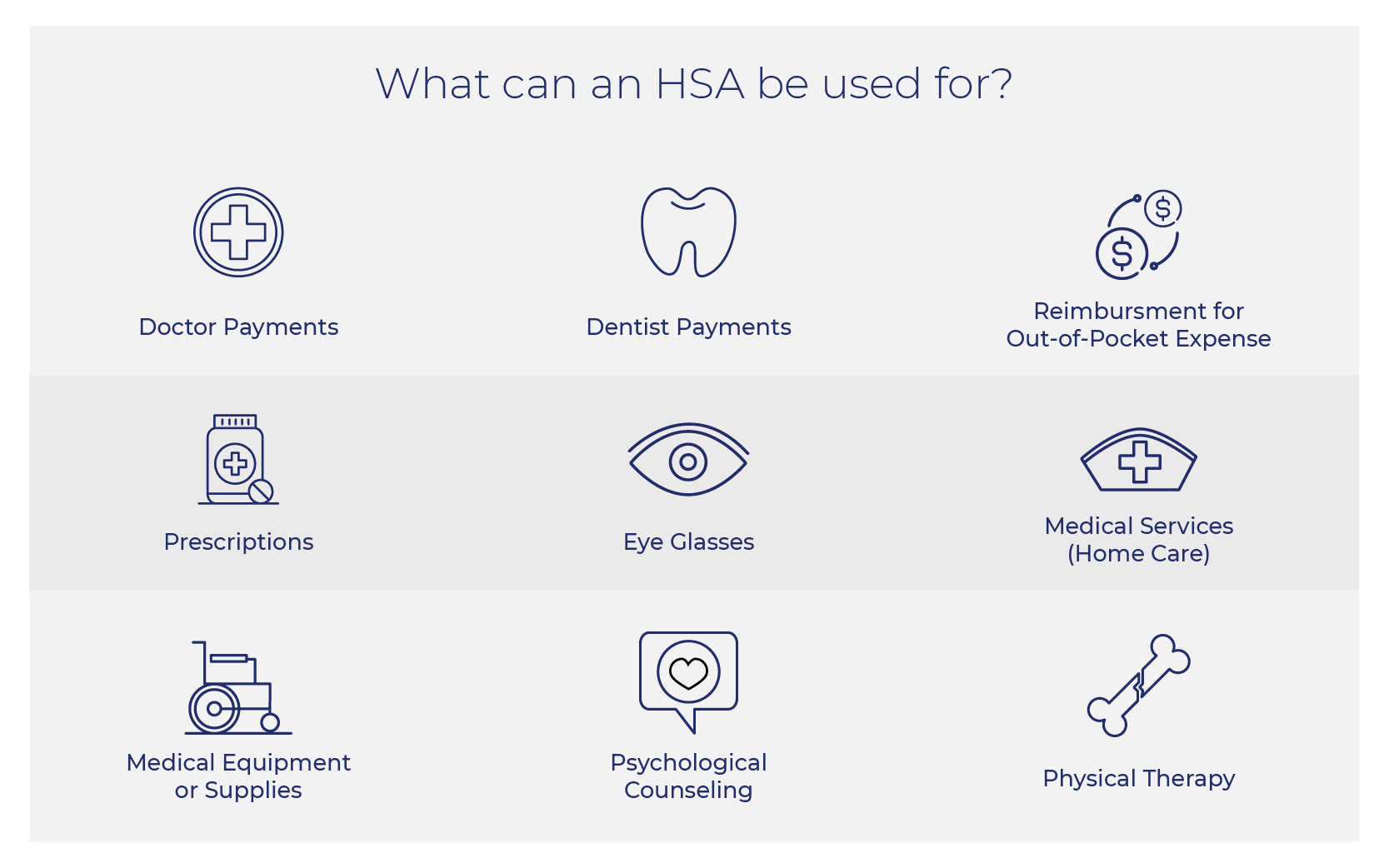

Similar to saving for a rainy day or retirement, you can save for your own health. A Health Savings Account lets you save money for things like doctor visits, prescription medication and other medical expenses.

Unlike some other plans, you own your HSA – not your employer. This money is yours to roll over year-after-year and you can use this money at any time, whether it’s five months or five years from now.

Here is some basic information about a Health Savings Account:

- You must be covered under a high deductible healthcare plan

- There is no setup or annual fees

- Contributions are tax deductible*

- Interest grows tax free*

- Withdrawals are tax free* when used for qualified medical expenses

- Money rolls over year-to-year automatically

- HSA is owned by you, not your employer

- Easy withdrawal access

- Debit card option available

What is an HSA?

A Health Savings Account allows to save money for things like medical expenses, prescription medication and doctor visits and contributions to this account are tax free.

How does an HSA work?

You own your own HSA account – not your employer. The money is yours to use at any time. Contributions are tax deductible and can grow interest that is tax free*. Withdrawals are also tax free* when used for qualified medical expenses.

So, what’s the catch?

You must be covered under a high deductible healthcare plan. You will need to work with your tax advisor to determine your eligibility. There is an annual contribution limit on HSAs. Consult a tax advisor or reach out to the bank for these limits as they can change annually.

How do I spend the money in my HSA?

HSA account holders can order checks and/or a debit card. There is typically no limit to the number of transactions you can have per month.

*The above items may qualify.

What do I need to open an HSA account?

You will need your driver’s license, address (if it’s different from your driver’s license, you will need proof of your address), your social security number, your date of birth and a deposit that meet’s your bank’s minimum amount required. It’s also critical to think about who your beneficiary on your HSA will be. You will need their name, address, birthdate and social security number. You can also identify an authorized signer; however, a joint owner is not allowed.

What comes with an HSA account?

Health Savings Accounts come with access to The Bank of Tioga’s online banking and mobile app along with a debit card. Learn more about these features by clicking on the icons below.

Can I add my HSA account to my digital wallet?

Yes! With digital wallets, you can have a touch-less experience at the checkout. Where accepted, simply hold up your phone to pay for your purchase on most smart phones.

How do I open an HSA account?

If you would like to open a Health Savings Account at The Bank of Tioga, simply contact us via phone at 701.664.3388, email, in-person or "Connect Now" below to get started.

DO MORE with your money at The Bank of Tioga

At The Bank of Tioga, we IGNITE PROSPERITY® by helping our clients do more with their money. Whether it’s saving a little extra cash each month or accomplishing a long-term strategy, our goal is to help you transform your financial life. Call and schedule an appointment today, one of our team members would love to help you do more with your money at The Bank of Tioga. The Bank of Tioga has two locations in North Dakota. For more information visit thebankoftioga.com, call 701.664.3388 in Tioga or 701.965.6333 in Crosby. #igniteprosperity