Four tax efficiencies before and during retirement

April 8, 2021

If you are like many Americans, you think about your taxes once a year, often around tax time. At that point, it can be too late to make changes to lower your taxes, and then you often forget to make that same change the following year. Now while immediate tax planning is important, have you ever thought about what your tax situation may look like in retirement as well? Below are four things you may want to think about no matter what age you are.

- Is Social Security taxable? Like any good answer, it depends. If you only receive Social Security in retirement and have no other income or retirement accounts, your gross income will be $0 and you won’t have to file a federal income tax return. If you receive a pension or have traditional retirement accounts you receive money from in a year, you may have to pay taxes. For a married couple filing jointly whose adjusted gross income plus half Social Security benefit is between $32,000 and $44,000, they may have to pay taxes on 50 percent of their Social Security. If this calculation is above $44,000, that couple may have to pay taxes on up to 85 percent of their Social Security.

- Traditional retirement account tax treatment. If you read #1 and are now trying to figure out your adjusted gross income, part of that income may be coming from a traditional retirement account. These can include 401(k)’s, IRA’s, 403b’s, etc. Most types of accounts you place pre-tax money into, you'll need to pay taxes when you take the money out. Thus, when you are retired and take money from your IRA, that may be taxable income that can put you into a higher tax bracket or make more of your Social Security taxable. Knowing the types of accounts you have is important, so you know how to treat them.

- Can I diversify my retirement income? Of course! We talked about traditional accounts, but you can also invest into Roth accounts. Roth’s take after-tax dollars to fund the account, so when you take money from the account in retirement it is tax-free. Using different accounts such as Traditional and Roth will help you to limit your taxable income in retirement, and fund some expenses with after-tax dollars.

- What are required minimum distributions (RMD)? Most retirement plans (except Roth accounts) are subject to RMD’s. Once an account owner turns 72 they will begin taking RMD’s, with the amount each year being determined by the federal government. Without going through the formula for RMD’s, the percentage you must take each year generally increases. For example, a 72 year old account owner will take between three to four percent that year of their traditional accounts. The percentage will continue to increase, and around age 90 that percentage will be roughly nine percent. This means no matter if you need the money from a traditional retirement account or not, at age 90 roughly nine percent of the account will need to come out and be reported on your tax return. This now brings us back to the issue, Social Security being taxed possible.

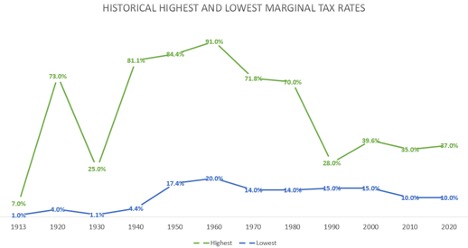

Below you'll see the historical highest and lowest marginal tax rates for those married filing jointly.

Looking at the chart, you can see compared to a majority of the time, we are in historically low tax rates right now. With federal tax rates already planned to go higher in 2026, it isn’t too late to alter your tax planning strategies. Contact us at 1.844.487.3030 if you need help thinking through what type of account you should have, or if you want to complete a Roth conversion.

At The Bank of Tioga, we IGNITE PROSPERITY® by helping our clients do more with their money. Whether it’s saving a little extra cash each month or accomplishing a long-term strategy, our goal is to help you transform your financial life. Call and schedule an appointment today, one of our team members would love to help you do more with your money at The Bank of Tioga. The Bank of Tioga has two locations in North Dakota. For more information visit thebankoftioga.com or call 701.664.338 for Tioga or 701.965.6333 for Crosby.

|

Matt Riley - Fiduciary Officer, VP, ChFC

Matt Riley currently serves as a Fiduciary Officer and VP for TS Prosperity Group (TSPG), helping clients across the Midwest meet their prosperity goals through investment and estate planning. Matt is a proud Illinois State University Alumni, receiving his B.S. in Finance with an emphasis in Financial Planning. He has continued his education journey, earning other designations including the Chartered Financial Consultant designation.

701.664.3388

|

Investment products provided by TS Prosperity Group are: • Not a Deposit • Not FDIC Insured • Not Insured by any Federal Government Agency • Not Guaranteed by the Bank • May Go Down in Value